The smart Trick of Invoice Factoring That Nobody is Discussing

Table of ContentsThe Basic Principles Of Invoice Factoring Facts About Invoice Factoring UncoveredSome Known Questions About Invoice Factoring.Facts About Invoice Factoring Revealed

You may additionally refer Factoring as receivables factoring, invoice factoring, and sometimes mistakenly balance due funding. Accounts receivable funding is a form of asset-based financing (ABL) using a business's accounts receivable as security. The Factoring Process Your B2B or B2G business offers products or solutions to bigger creditworthy customers as well as send proper invoices.

The factoring company after that pays the equilibrium of the billing back to the B2B or B2G business minus a cost. When comprehending billing factoring, it is vital to remember that factoring varies from borrowing in companies sell balance dues instead of just function as collateral. The net result is that your firm can transform its receivables into immediate operating cash.

Non choice factoring supplies the included advantage of security against bankruptcy or bankruptcy. Only the very best, most experience factoring companies have the ability to use non option to their clients. This is particularly vital in today's financial atmosphere of uncertainty. Expect the unexpected as local business owner must be thorough in protecting their own interests and also incomes.

How Invoice Factoring can Save You Time, Stress, and Money.

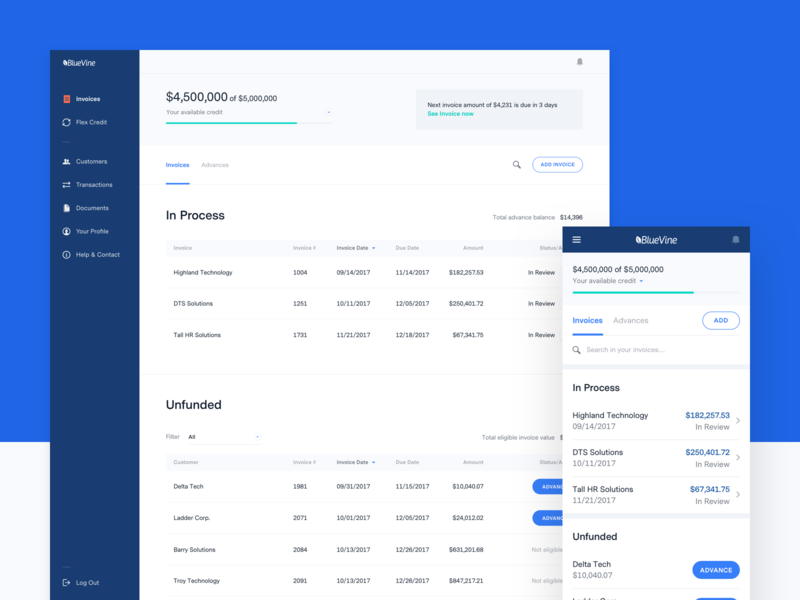

Your organization receives the money it needs when it requires it, so you can best handle your service. invoice factoring. Invoice factoring can be an outstanding choice for business that need money rapidly however that aren't able to safeguard a traditional small business loan. Numerous describe company factoring by several names such as receivables factoring, billing discounting, billing factoring, and also borrower financing.

Factors will certainly want to be certain that these business have a history of paying their costs. The factor will certainly likewise supply non-recourse factoring. Non-recourse secures your firm when it comes to your client going financially troubled during the deal period. Fully recognizing invoice factoring is a wonderful way for firms to infuse cash into their company without taking on added financial obligation.

Billing factoring is sometimes referred to as 'factoring', or 'debt factoring'. It is a monetary product that makes it possible for organizations to sell unsettled billings (balance dues) to a third-party factoring firm (a factor). The factoring company buys the billings for a portion of their total value and also then takes duty for gathering the invoice settlements.

The basic actions are as adheres to: You send information of your invoices to the factor to identify if you are qualified for the factoring center. The billing factoring business will certainly after that evaluate useful reference just how dangerous they feel the financing is (this is market certain, along with concerning your particular customers) and also will after that give you their quote.

Our Invoice Factoring Diaries

The aspect will after that begin collection of the billing with your customersOnce the billing has been collected, the element will certainly pay you the remaining balance of your money, minus their fee Recap After eligibility is established, the factoring business will acquire the unsettled invoices for a portion of their worth and afterwards take over the financial debt collection process.

In assessing qualification, factoring firms will websites certainly look at numerous variables, consisting of: The dimension and origin of the billings you're looking for settlement forTime framesPotential risksYour own firms credit report and track record This last factor to consider is much less crucial because the genuine threat for the aspect exists with the integrity of the business owing the impressive billing.

Indicators on Invoice Factoring You Need To Know

Billing financing can be excellent for brand brand-new services, startups and even companies with poor credit history, as a way of acquiring financing more efficiently. The rates top article might simply be somewhat higher, consequently for less well established businesses, or those with negative credit scores. Recap Yes. Any company can use invoice factoring, yet it may just be ideal where invoices are taking 30-90+ days to make money, to aid with cash-flow.